Palma VMS Cu-Zn Project

Infrastructure & Location

- Sealed roads to Palmeiropolis (12,000 inhabitants) ~15km away from main deposits (C3, C1). 6 hours from Brazil’s capital city, Brasilia.

- Hydro Energy: local 100% hydroelectricity with high kv transmission lines available.

- Rail access to Ports and Smelters: Proximity to railways (70-80km) providing access to ports and smelters.

- Strong community engagement: Local, State and Federal political support for the Project.

- Rural area with farming as main land use

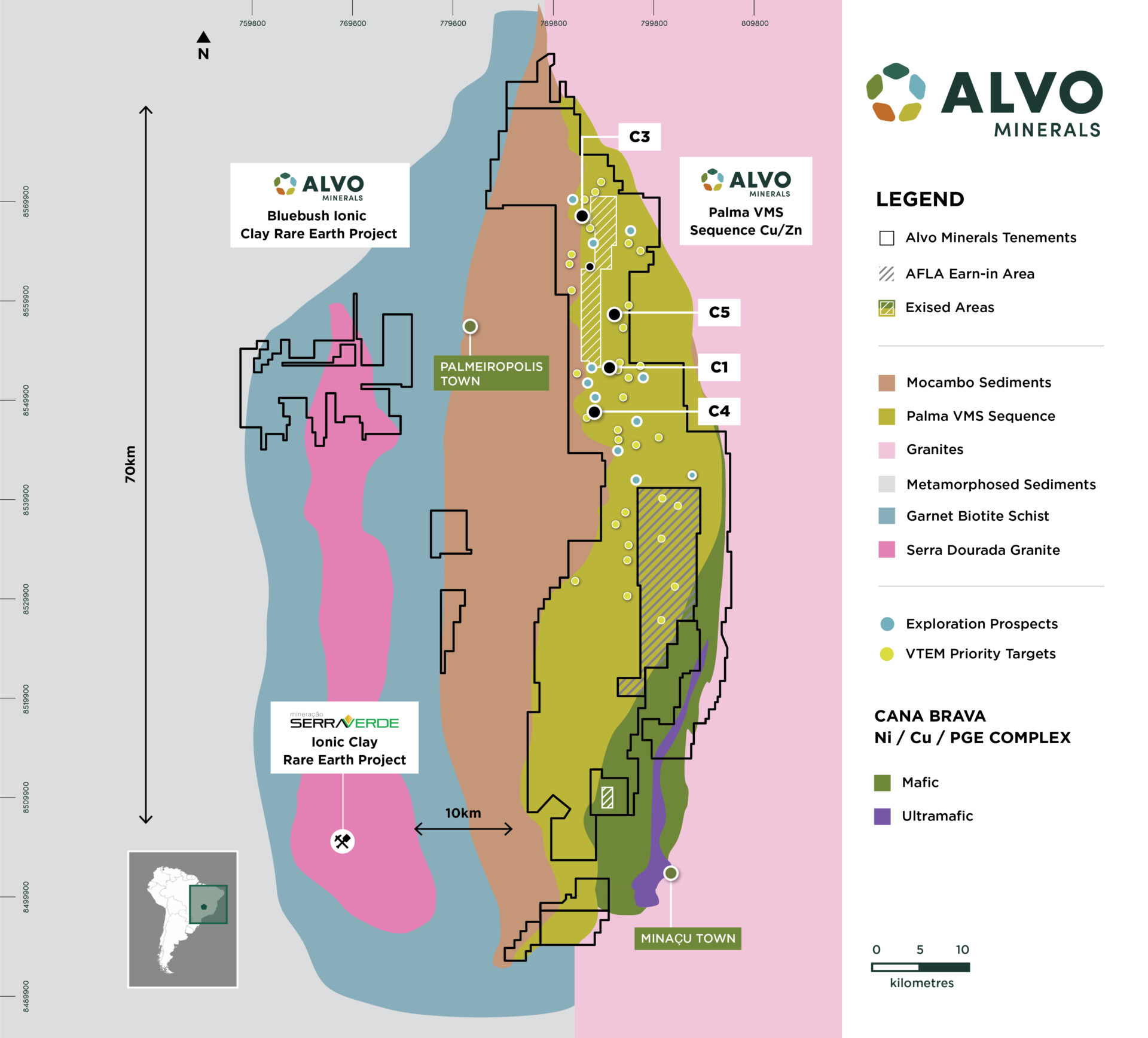

Overview

- Palma VMS District is a known VMS District comprised of 5 high-grade Copper and Zinc rich, shallow mineralised prospects in Central Brazil. Alvo controls >80% of this district with >850km2 of contiguous and highly prospective ground.

- VMS deposits typically occur in clusters, where multiple deposits can be located in similar geological districts. These districts can host tens of VMS deposits that range in size from less than 1Mt to exceeding 100Mt.

- Palma contains high-Grade, shallow, polymetallic prospects – 5 prospects drilled historically in the district. JORC resources on only 2 deposits (C1 and C3).

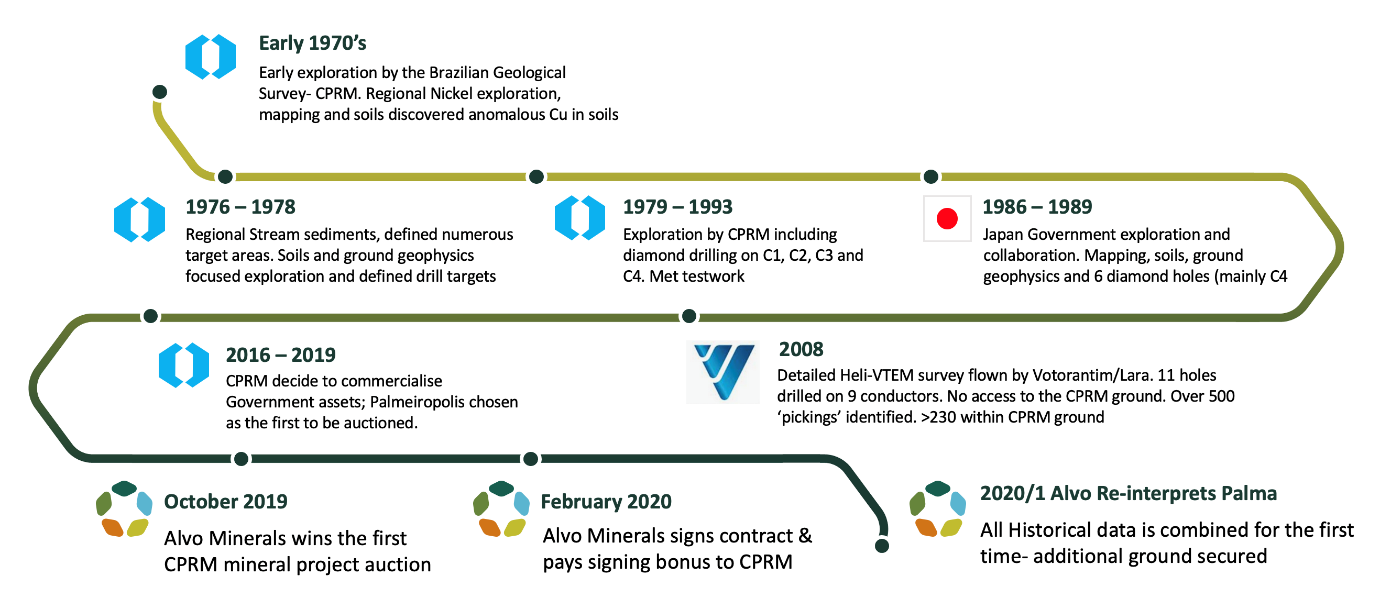

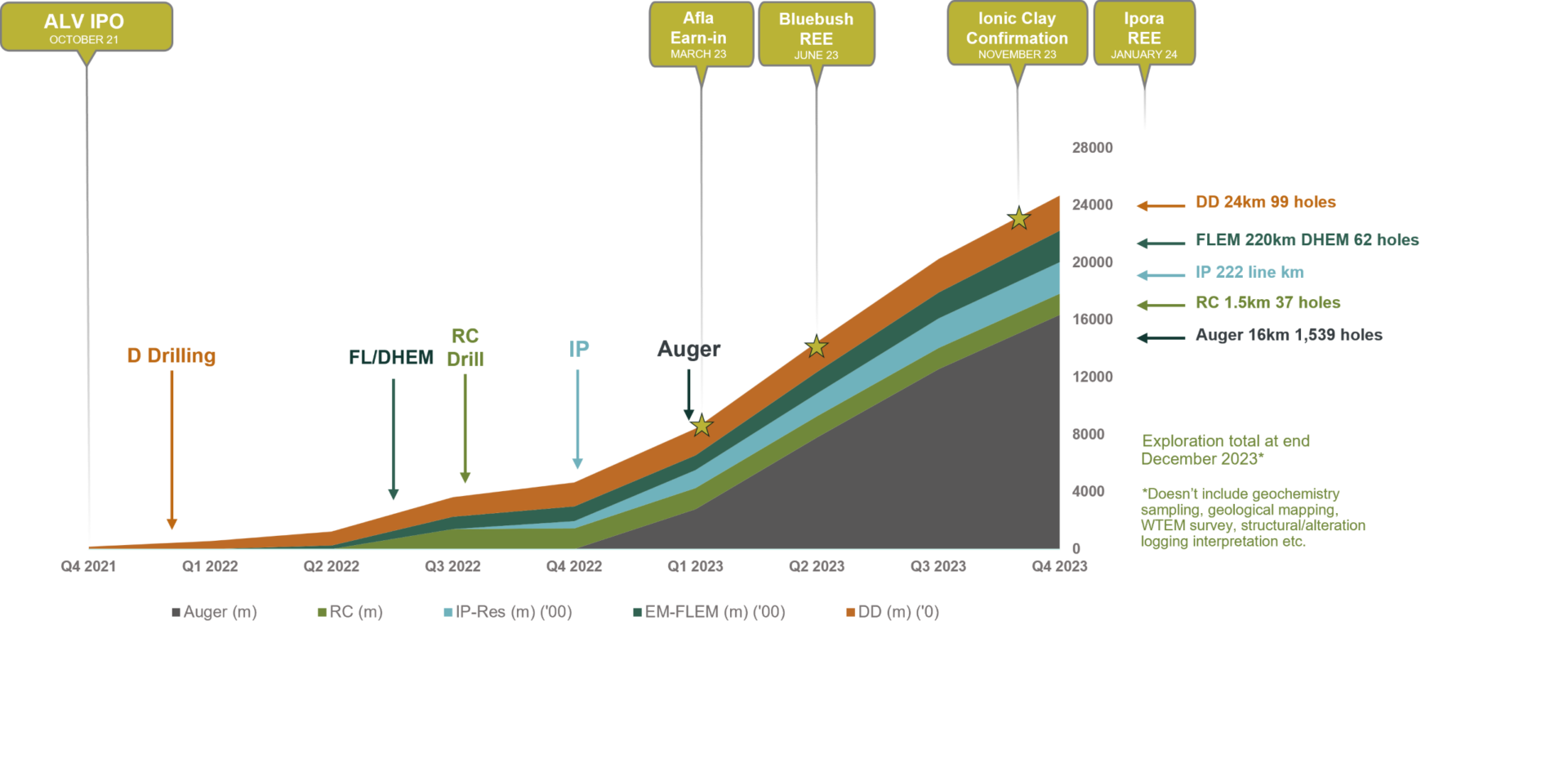

- Discovered in the 1970s, the project has been largely idle for >30 years. Alvo is the first to apply modern / systematic / aggressive exploration techniques. >32,000 meters of Diamond drilling completed (historic); >21,500m of diamond drilling by Alvo since listing in Oct. 2021.

- Preliminary metallurgical testwork completed in 1980’s- good recoveries and high-grade concentrates.

Alvo’s drill results continue to exceed expectations on grade and thickness compared to existing MRE:

- 36.0m @ 4.2% CuEq^ or 10.2% ZnEq^ – C3

- 23.2m @ 5.5% CuEq or 13.4% ZnEq – C3

- 19.7m @ 4.7% CuEq or 11.41% ZnEq – C3

- 16.0m @ 6.4% CuEq or 15.57% ZnEq – C3

- 21.8m @ 4.8% CuEq or 11.72% ZnEq – C1

^ CuEq and ZnEq: Copper and ZnEq Equivalent Calculation

The copper and zinc equivalent grades (CuEq & ZnEq) are based on copper, zinc, silver, lead and gold prices of US$7,782/t Copper, US$3,189/t Zinc, US$1,980/t Lead, US$19.30/oz Silver, and US$1,696/oz (price deck based on 3-month LME as 7/11/22). Recoveries of 81%, 83%, 70%, 50% and 50% respectively, (recoveries based on Metallurgical testwork released in ASX Announcement 9 November 2022).

The copper equivalent calculation is as follows (for ZnEq, replace Cu in the calculation): Cu Eq = Cu grade% * Cu recovery + ((Pb grade % * Pb recovery % * (Pb price $/t/Cu price$/t)) + (Zn grade % * Zn recovery % * (Zn price $/t/Cu price $/t)) + (Ag grade g/t /31.103 * Ag recovery % * (Ag price $/oz/Cu price $/t) + (Au grade g/t /31.103 * Au recovery % * (Au price $/oz/Cu price $/t). Reported on 100% Basis.

Project History

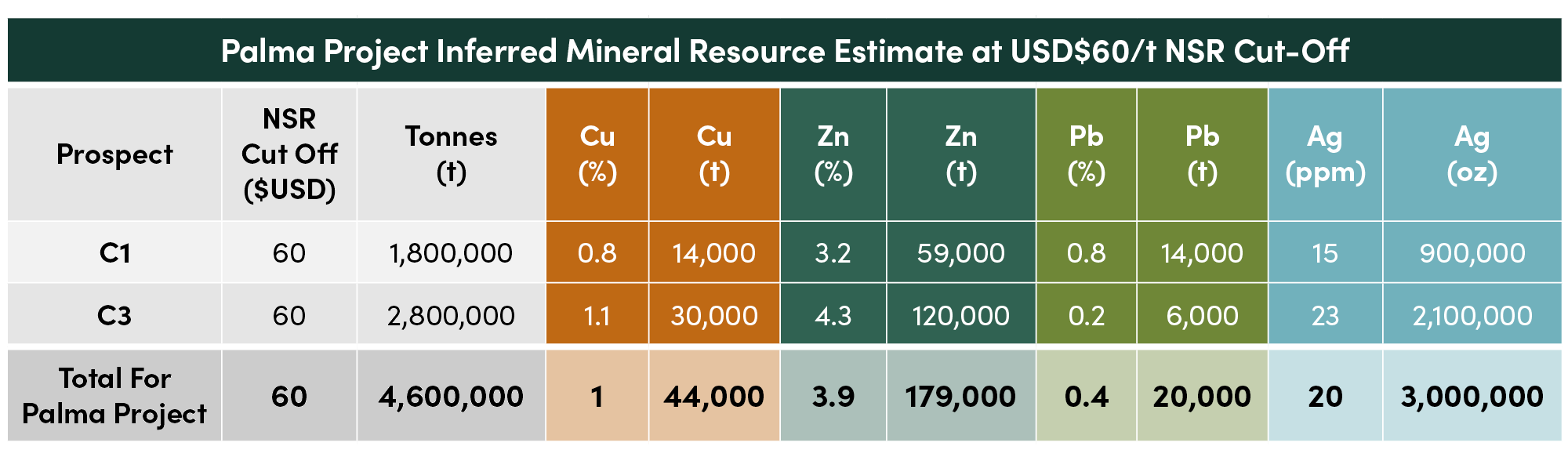

Mineral Resource Estimate

Note: The NSR has been calculated using the following prices: 2.90$/lb Cu, 1.04$/lb Zn, 0.79$/lb Pb, 24.5$/oz Ag and assuming recoveries of 90% for all metals in sulphide and 45% for all metals in oxides. Due to the rounding in the table, values may not add-up.

* For full details of the inferred MRE including JORC compliant information, please refer to the Alvo prospectus lodged with ASX and dated 30 July 2021

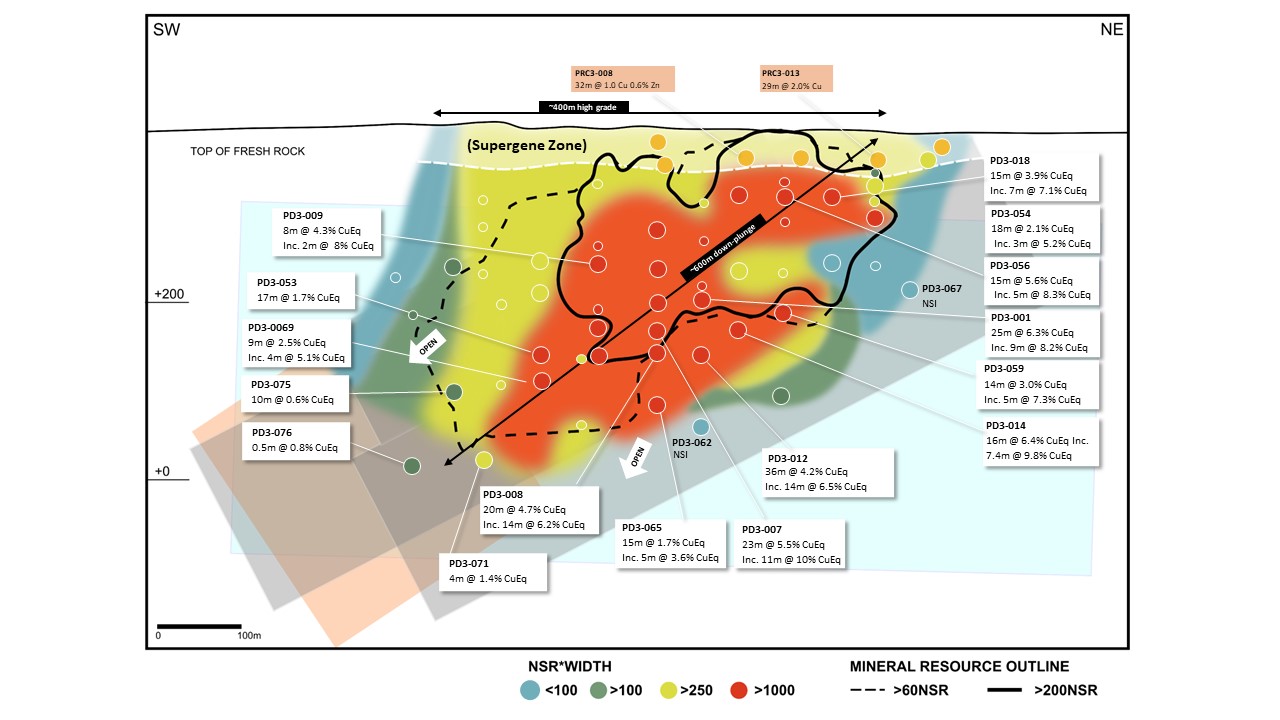

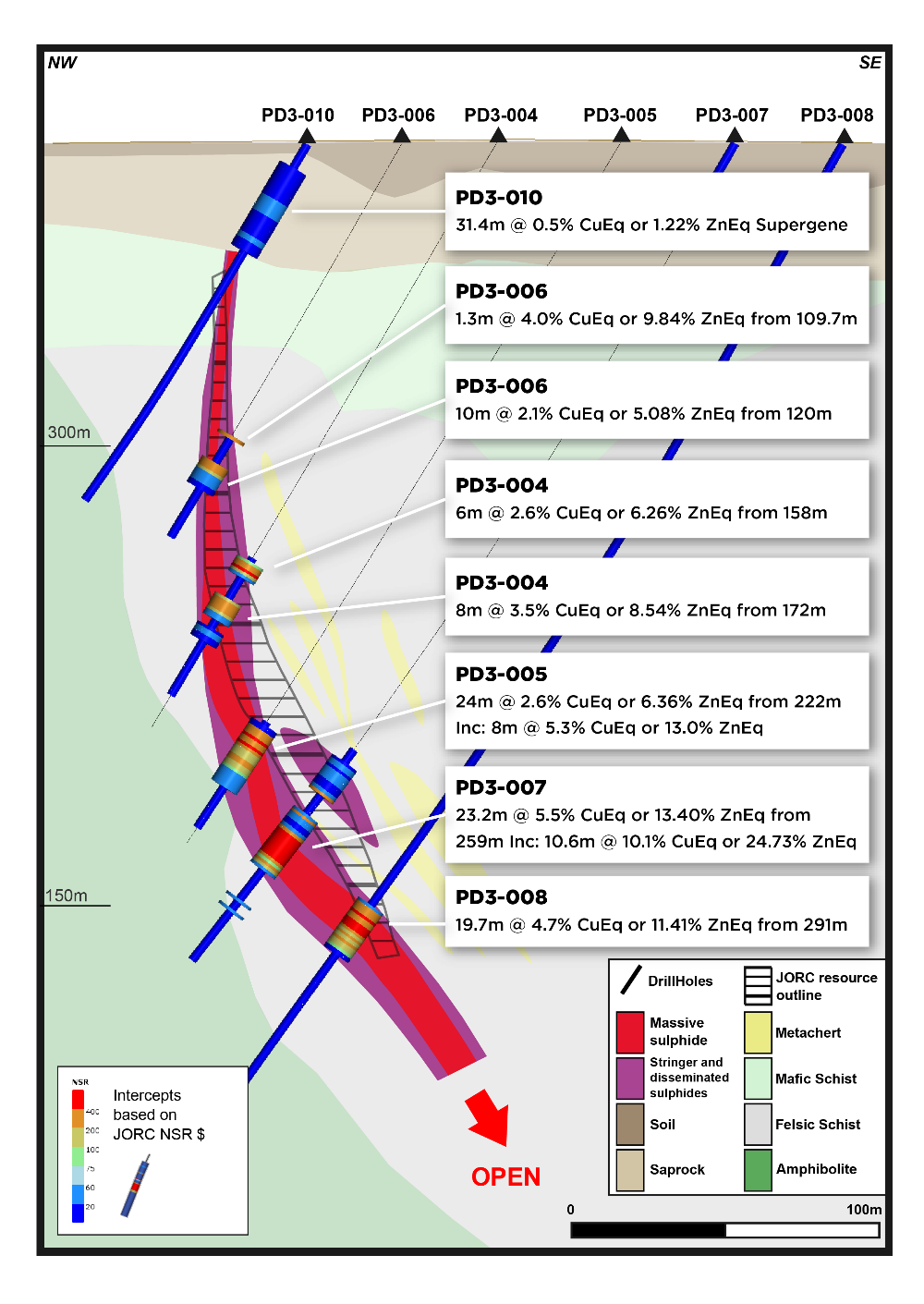

C3 Prospect

- C3 has the highest copper grades, with mineralisation open at depth and along strike.

- C3 JORC 2012 Inferred Mineral Resource Estimate of 2.8Mt @ 1.1% Cu, 4.3% Zn, 0.2% Pb & 23g/t Ag.

- New Alvo drilling has returned multiple high-grade intercepts which aim to grow the resource.

- PD3-001: 25.0m @ 6.3% CuEq or 15.34% ZnEq

- PD3-007: 23.2m @ 5.5% CuEq or 13.4% ZnEq

- 10.6m @ 10.1% CuEq or 24.73% ZnEq

- PD3-008: 19.7m @ 4.7% CuEq or 11.41% ZnEq

- PD3-012: 36m @ 4.2% CuEq or 10.20% Eq

- PD3-014: 16.0m @ 6.4% CuEq or 15.57% ZnEq

- 7.4m@ 9.8% CuEq or 23.81% ZnEq

- PD3-018: 15.0m @ 3.9% CuEq or 9.51% ZnEq

- Phase 2 drilling is underway targeting C3 extensions.

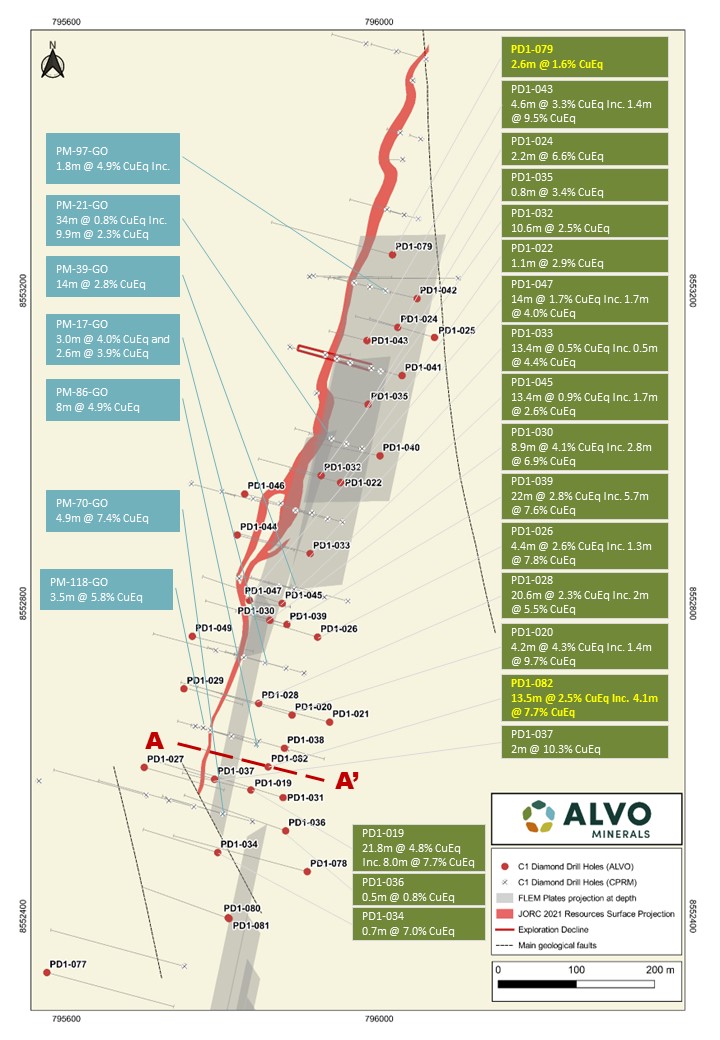

C1 Prospect

- C1 is mineralised over 1.2km of strike – open at depth and along strike.

- C1 JORC 2012 Inferred Resource of 1.80Mt @ 0.8% Cu, 3.2% Zn, 0.8% Pb & 15g/t Ag.

(Gold mineralisation not routinely assayed and not reported). - Phase one diamond drilling intercepted significant polymetallic massive/semi-massive and disseminated sulphides:

- PD1-019: 21.8m @ 4.8% CuEq^ or 11.72% ZnEq from 142m

- 8.0m @ 7.7% CuEq or 18.80% ZnEq from 149m

- PD1-030: 9m @ 4.1% CuEq or 10.07% ZnEq from 64m

- 2.8m @ 6.9% CuEq or 16.76% ZnEq from 64m

- PD1-028: 20.6m @ 2.3% CuEq or 5.72% ZnEq from 84m

- 2.1m @ 5.5% CuEq or 13.53% ZnEq from 103m

- PD1-029: 6.2m @ 2.9% CuEq or 7.16% ZnEq from 105m

- PD1-019: 21.8m @ 4.8% CuEq^ or 11.72% ZnEq from 142m

- Fixed loop Electromagnetic Survey (FLEM) highlighted potential extensions down dip and new targets to the south – drilling and DHEM to test these positions.

- Phase 2 drilling to follow with MRE update and phase 2 result

Metallurgical Testwork

Metallurgical testwork is currently underway on samples from the C1 and C3 prospects at flotation specialists in Perth WA. The results of these tests are expected in second half of 2023.

CPRM undertook bench and pilot plant testwork in 1982 and 1988.

1982: Float tests on 400kg of sulphide mineralisation from drilling at C1

- Bond Work Index of 13.0 kWh/t

- Flotation tests for Cu recovered 72% in a 20% concentrate and Zn recovered 78% in a 50% concentrate

1988: 2 stages including

- Bench scale flotation tests on C3 drill holes

- Zn flotation of 75% recovery and 42% concentrate grade

- Cu & Pb flotation test results- 82% & 69% recoveries and 12% & 9.5% concentrate grade

- Bulk flotation test Cu & Pb & Zn- recoveries of 89% & 72% & 90% with 3.6% & 2.6% & 11.8% concentrate grades

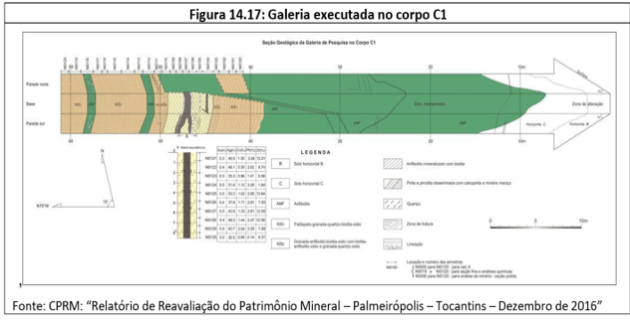

- Bench and Pilot plant test on C1 from an underground decline. 40 tonnes extracted and stored for 3 years (partially oxidised) affecting testing.

- Bond Work Index of 13.7 kWh/t

- Results generally confirmed the 1982 bench scale results with concentrates of Cu & Zn achieving recoveries of 72% & 75%and concentrate grades of 21% & 45 % respectively

Figure below illustrates mapping along the decline into C1, from which a 40 tonne sample was extracted for metallurgical testwork in 1988. The sample was left uncovered on site for 3 years before testing through the pilot plant.

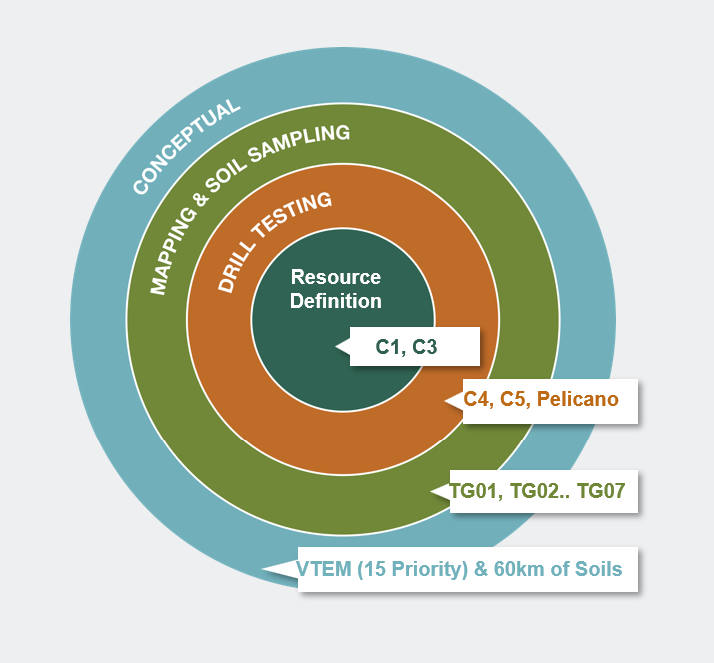

Exploration Targets

Alvo’s 2022 exploration program focused on the Company’s existing deposits, C1 and C3. These two existing deposits are only two of more than 20 late-time conductors identified through the VTEM survey flown in 2008 that covers over 60km of prospective strike.

Since estimating the Maiden Mineral Resource Estimate (“MRE”) at IPO in 2021 of 4.6Mt @ 1.0% Cu, 3.9% Zn, 0.4% Pb & 20g/t Ag (based on historical drill results completed by the CPRM), Alvo has completed >21,500m of diamond drilling and 1,467m of Reverse Circulation (“RC”) drilling.

In addition, the Company has completed extensive geological logging, multiple geophysical surveys (IP, FLEM and DHEM) and completed over 4,100m of regional auger geochemical drilling across the 70+ km of prospective geology.

This information gathered has enhanced Alvo’s technical team’s knowledge and understanding of the Palma VMS district, enabling the team to continue effective exploration across the regional target area.

Exploration work is underway across multiple prospects with the aim of advancing a pipeline of prospects to drill-ready status. Field activities including geological mapping, soil sampling, auger geochemical drilling (“Auger”), IP surveys and fixed loop electromagnetic surveys (“FLEM”) are being undertaken concurrently on various prospects within the district. Sampling (soils, trenching and auger geochemistry) is typically processed in Alvo’s core shed where preparation includes drying (several drying ovens have been built), screening and then samples are tested with a hand-held XRF.

Utilising the Company’s in-house equipment allows for flexible, fast and efficient exploration that is significantly less expensive than contracted exploration, as the only material expense is labour.

Competent Persons Statement:

The information on this website relating to Mineral Resource Estimate includes information that is based on or extracted from the Independent Geologists Report prepared by Target Latin America and others, which is included in full in Alvo’s prospectus dated 30 July 2021 (the IGR).

The information contained on this website that relates to recent exploration results is based upon information compiled by Mr Rob Smakman of Alvo Minerals Limited, a Competent Person and Fellow of the Australasian Institute of Mining and Metallurgy. Mr Smakman is a full-time employee of Alvo and has sufficient experience relevant to the style of mineralisation and type of deposit under consideration and to the activity which he is undertaking to qualify as a Competent Person as defined in the “Australasian Code for Reporting of Mineral Resources and Ore Reserves” (or JORC 2012). Mr Smakman consents to the inclusion in this announcement of the matters based upon the information in the form and context in which it appears.